At the beginning of the

new millennium, the research shifted its attention to an

increasing number of regional and ethnic conflicts (Africa, Bosnia, Kosovo, Afghanistan, Iraq), international terrorist threats (terrorist attacks on the USA) and weapons of mass destruction. Besides that, much work was dedicated to

NATO,

the European Union and other alliances that accepted new members and continued with developing new missions, rules and international organizations, an example being the

European Security and Defence Policy, which involved the introduction of the European Defence Equipment Market and the European Defence Technological and Industrial Base.

War-finance measures may include

levy of specific taxation, increase and

enlarging the scope of existing taxation,

raising of compulsory and voluntary loans from the public,

arranging loans from foreign sovereign states or financial institutions, and also the

creation of money by the government or the central banking authority.

Loot and plunder - or at least the prospect of such - may play a role in war economies. This involves the taking of goods by force as part of a military or political victory and was used as a significant source of a revenue for the victorious state. During the first World War when the Germans occupied the Belgians, the Belgian factories were forced to produce goods for the German effort or dismantled their machinery and took it back to Germany – along with thousands and thousands of Belgian slave factory workers.

If Day ("

Si un jour", "If one day") was a

simulated Nazi German invasion and occupation of the Canadian city of

Winnipeg, Manitoba, and surrounding areas on

19 February 1942, during the

Second World War. It was organized by the Greater Winnipeg Victory Loan organization, which was led by prominent Winnipeg businessman

J. D. Perrin. The event was the largest military exercise in Winnipeg to that point.

If Day included a

staged firefight between Canadian troops and volunteers dressed as German soldiers, the

internment of prominent politicians, the

imposition of Nazi rule, and a

parade. The event was a fundraiser for the war effort:

over $3 million was collected in Winnipeg on that day. Organizers believed that the fear induced by the event would help increase fundraising objectives. It was the subject of a 2006 documentary, and was included in

Guy Maddin's film

My Winnipeg.

War bonds are

debt securities issued by a government to finance military operations and other expenditure in times of war. War bonds are either retail bonds marketed directly to the public or wholesale bonds traded on a stock market. Exhortations to buy war bonds are often accompanied by appeals to patriotism and conscience. Retail war bonds, like other retail bonds, tend to have a yield which is below that offered by the market and are often made available in a wide range of denominations to make them affordable for all citizens.

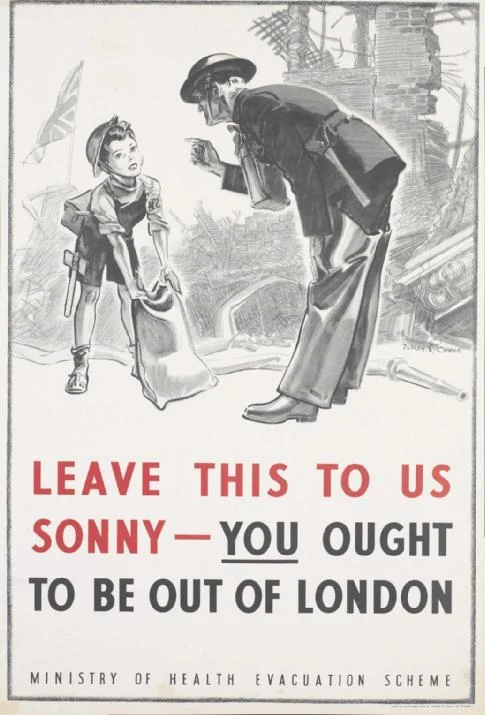

In the

United Kingdom, the

National Savings Movement was instrumental in raising funds for the

war effort during both world wars. During World War II a War Savings Campaign was set up by the

War Office to support the war effort. Local savings weeks were held which were promoted with posters with titles such as "Lend to Defend the Right to Be Free", "Save Your Way to Victory" and "War Savings Are Warships".

Canada's involvement in the Second World War began when Canada declared war on

Nazi Germany on September 10, 1939, one week after the United Kingdom. Approximately half of the Canadian war cost was covered by War Savings Certificates and war bonds known as "Victory Bonds" as in World War I.

War Savings Certificates began selling in

May 1940 and were sold door-to-door by volunteers as well as at banks, post offices, trust companies and other authorised dealers. They matured after seven years and paid $5 for every $4 invested but individuals could not own more than $600 each in certificates. Although the effort raised

$318 million in funds and was successful in financially involving millions of Canadians in the war effort, it only provided the Government of Canada with a fraction of what was needed.

The sale of

Victory Bonds proved far more successful financially. There were

ten wartime and

one postwar Victory Bond drives. Unlike the War Savings Certificates, there was

no purchase limit to Victory Bonds. The bonds were issued with maturities of between six and fourteen years with interest rates ranging from 1.5% for short-term bonds and 3% for long-term bonds and were issued in denominations of between $50 and $100,000. Canadians bought

$12.5 billion worth of Victory Bonds or some

$550 per capita with

businesses accounting for

half of all Victory Bond sales.

The first Victory Bond issue in

February 1940 met its goal of

$20 million in

less than 48 hours, the second issue in

September 1940 reaching its goal of

$30 million almost as quickly.

When it became apparent that the war would last a number of years the war bond and certificate programs were organised more formally under the

National War Finance Committee in

December 1941, directed initially by the president of the

Bank of Montreal and subsequently by the Governor of the

Bank of Canada. Under the more honed direction the committee developed strategies, propaganda and the wide recruitment of volunteers for bonds drives. Bond drives took place every six months during which no other organization was permitted to solicit the public for money. The government spent over $3 million on marketing which employed posters, direct mailing, movie trailers (including some by Walt Disney), radio commercials and full page advertisement in most major daily newspaper and weekly magazine.

Realistic staged military invasions, such as the

If Day scenario in

Winnipeg,

Manitoba, were even employed to

raise awareness and shock citizens into purchasing bonds.